Individual Income Tax Filing on WhatsApp: Step-by-Step Guide to File Your Sri Lankan Tax Return Using WhatsApp

Filing individual income tax returns in Sri Lanka has traditionally been a complex and time-consuming process that many working professionals dread. From navigating the IRD’s online portal to understanding tax computations and ensuring compliance with ever-changing regulations, the annual tax filing season brings stress to thousands of salaried employees across the country.

This challenge is particularly acute for Sri Lanka’s growing tech sector, where busy professionals often struggle to find time for tax compliance while managing demanding work schedules. Many end up paying penalties for late filing or missing important deductions simply because the process feels overwhelming.

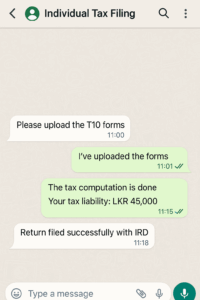

Simplebooks has introduced a game-changing solution: WhatsApp Individual Income Tax Filing to address this challenge and empower Sri Lankan professionals. This innovative platform simplifies the entire tax filing process, making it as easy as having a conversation on WhatsApp. By leveraging the familiar interface that millions of Sri Lankans use daily, Simplebooks has effectively bridged the gap between complex tax requirements and user-friendly technology.

How to File Your Individual Income Tax Return Using WhatsApp

Filing your 2024/25 individual income tax return has never been easier. Follow these simple steps to complete your tax filing in minutes:

Step 1: To begin the filing process via WhatsApp, contact us at +94 72 447 0173. Save this number and send us a simple “Hi” to get started.

Step 2: Answer simple questions about your additional income sources (if any), such as business income, or investment returns. Our chat-based interface makes this process intuitive and error-free.

Step 3: Review your tax computation which will be automatically calculated based on the 2024/25 tax rates and allowances. You’ll see a clear breakdown of your taxable income, tax liability, and any refunds due.

Step 4: Review your complete tax return summary and submit for review once you are satisfied

Note: Please be patient during the process. After sending information, wait for our system to process it (usually 1-2 minutes). Our human consultants are available within the chat if you need additional assistance at any step.

Benefits of WhatsApp Tax Filing with SimpleBooks

1. Zero Learning Curve: File your taxes using WhatsApp, the app you already know and use daily. No need to learn complex software or navigate confusing government portals.

2. Expert Tax Computation: Our system handles all 2024/25 tax calculations automatically, ensuring you claim all eligible deductions and allowances while staying compliant with Sri Lankan tax law.

3. Multilingual Support: Available in Sinhala, Tamil, and English to serve Sri Lanka’s diverse professional community with clear communication in your preferred language.

4. Human Expert Backup: When you need clarification or have complex questions, our qualified tax consultants are available directly within the WhatsApp chat – no need to call separate helplines.

5. Complete Audit Trail: All your conversations, documents, and filed returns are securely stored, giving you a complete history for future reference and IRD inquiries.

Who Should Use This Service?

Primary Users:

- Salaried Tech Professionals: Software engineers, IT consultants, and tech industry employees with busy schedules

- Banking and Finance Professionals: Employees in banks, insurance companies, and financial services

- Corporate Employees: Staff in multinational companies, telecommunications, and large local corporations

Perfect For:

- First-time Filers: New graduates entering the workforce who need guidance

- Busy Professionals: Anyone who values time and wants to avoid the hassle of traditional filing methods

- Returnee Professionals: Sri Lankans returning from abroad who need to understand local tax requirements

Frequently Asked Questions

Q: Is my personal and financial information secure on WhatsApp?

A: Yes, we use end-to-end encryption and follow strict data protection protocols. All sensitive tax information is processed through secure, IRD-compliant channels.

Q: How long does the entire filing process take?

A: Most users complete their tax filing in 10-15 minutes. Complex cases with multiple income sources may take up to 30 minutes.

Q: What if I make a mistake or need to amend my return?

A: Our system includes review steps to minimize errors. If amendments are needed after filing, our tax consultants will guide you through the IRD’s amendment process.

Q: Do you handle tax planning and advice for next year?

A: Currently, we focus on filing for 2024/25. We can answer general questions about 2025/26 tax planning, with full computation services for that year coming soon.

Q: What happens if the IRD rejects my return?

A: Our system is designed to minimize rejections through built-in validation. If issues arise, our consultants will help resolve them and resubmit your return at no additional cost.

Get Started Today

Don’t let tax filing stress overwhelm you this year. Join thousands of Sri Lankan professionals who have discovered the easiest way to file their individual income tax returns. Send us a WhatsApp message today and experience hassle-free tax compliance.

Ready to file your 2024/25 tax return in minutes? Contact Simplebooks on WhatsApp and take the first step towards stress-free tax filing. Your time is valuable – let us handle the complexity while you focus on what matters most.