Updated 2025

As VAT regulations and rates change frequently, Sri Lankan business owners can find it challenging to stay up to date with the latest information. As a result, they may fail to take the necessary steps to remain compliant with tax regulations.

To make this process easier, we’ve created this guide covering everything you need to know about VAT Sri Lanka, including the current regulations, how to calculate your VAT rate, how and when to pay VAT payments, and how to avoid any fines or penalties.

What is Value Added Tax?

When goods and services are sold, they often pass through several stages before reaching the end customer. For goods, these stages typically include raw material purchase, manufacturing, distribution, retail, and finally purchase by the end customer. The government levies VAT at each stage; therefore, the more stages a product or service passes through from production to sale, the more times VAT will be applied. Let’s take a look at an example. Assume that 18% of VAT applies to the goods.

Example:

- Kamal wants to purchase a chair from a furniture store for Rs. 3000. When he buys the chair, the store also charges 18% VAT.

- Therefore, Kamal pays a total of Rs. 3540 to the store during his transaction. The store then pays the Rs 540 collected as VAT to the government.

- Since businesses collect VAT but the end consumer bears the cost, VAT is an indirect tax on all domestic and imported goods and services in Sri Lanka.

As the end customer pays the actual tax amount, VAT is called an indirect tax. It is also applicable to both goods and services supplied in Sri Lanka as well as imported goods. Depending on the point where VAT is charged, we can categorize it in two ways:

- Output VAT – Charged by your business when selling the goods and services to other companies or consumers.

- Input VAT – Paid by your business when purchasing taxable goods and services from other companies.

Below is an example of how input and output VAT is applied. (Assume that 18% of VAT applies to the goods).

- Kamal has a business that manufactures bikes.

- When Kamal manufactures bikes, he pays input VAT on his raw-materials purchases and collects output VAT on his sales; he remits to the government.

| Stage | Net Amount | VAT 18% | Gross Amount |

| Raw material purchase | 50,000 | 9,000 | 59,000 |

| Sales of finished bikes | 100,000 | 18,000 | 118,000 |

| Net VAT remitted | 9,000 |

Kamal paid a total of 59,000 LKR for raw materials, which includes 9,000 LKR of input VAT ( 50,000×0.18 ).

- Input VAT = 50,000 x 18% = 9,000 LKR

- Output VAT = 100,000 x 18% = 18,000 LKR

- Net VAT to remit – Output VAT (18,000) – Input VAT (9000) = 9,000 LKR

Who should pay VAT?

According to the Inland Revenue Department (IRD) of Sri Lanka, a certain threshold must be exceeded by businesses before they become liable to pay VAT. The government changed this threshold in January 2024 to apply only to companies with an annual turnover of Rs. 60 Million. Every business that exceeds these thresholds must register for VAT before charging VAT on the goods and services they sell.

Suppose the value of a business’s taxable supply (sales of taxable goods and services) exceeds the following thresholds. In that case, they must register to pay VAT.

- Businesses that have exceeded Rs. 60 million per annum.

- A business that is likely to exceed Rs. 60 million in the next 12 months

- Importers or exporters of goods for commercial purposes (turnover test not required).

- Businesses are required to register for VAT within 15 days of exceeding the threshold or, for importers/exporters, from the commencement of operations.

How to register for VAT?

Businesses cannot collect VAT without a VAT certificate issued by the Inland Revenue Department, Sri Lanka, authorising them to collect VAT on behalf of the government. A company can obtain a VAT Certificate through any of the following registration methods.

1. Compulsory Registration

As mentioned earlier, you must register for VAT within 15 days if your taxable supplies exceed – or are projected to exceed – Rs 60 million in any 12 months.

2. Forced Registration

There can be situations where a business has exceeded the threshold but has not requested to register for VAT Sri Lanka. In such cases, the Commissioner-General of the Inland Revenue Department has the power to register the business from a date decided by him.

Step 1 – obtain the taxpayer registration form from the Primary Registration Unit of the IRD or download it from the IRD website.

Step 2 – complete and submit it to the Taxpayer’s Service Unit (TPSU) at the IRD or send it by post. Alternatively, you can complete the submission online, using the IRD e-services.

Step 3 – Once you obtain your Tax Identification number, you can complete the VAT registration form and submit it to the Inland Revenue Department. This form can be obtained in person and online.

- In-person – You can obtain the VAT registration form either from the Tax Registration Unit or from any Regional Office of the Inland Revenue Department.

- Online: You can request a PIN through the e-services page to access all the e-services provided by IRD, including VAT registration.

You can submit it in person to the Taxpayer’s Service Unit (TPSU) at the Inland Revenue Department or send it by post. You can also submit it by using the online services of the IRD. Regardless of whether you submit in-person or online, you must also submit the following documents with the application.

- TIN Certification

- Certificate of Business Registration

- In case of limited liability company

- Articles of association

- List of Directors

- Certificate of incorporation

- Copies of NIC of the directors of the business

- Particulars of sales to prove the turnover

- Monthly Bank statements to verify cash receipts.

- Documents to prove that exports were made continuously by such exporters

- For 22(7) registration – Project Plan

- A copy of the agreement with the Board of Investment(if any)

- Deed or rent/lease agreement of the property

- Sources of funds for the project to be provided for non-BOI projects

- A list of intended purchases, both local and imports

Step 4 – If you submit the form in person, you could collect the VAT certificate within one hour, given all the required details are accurate. If you submit online, you will receive a PDF of the original certificate to your email.

What are the applicable VAT rates?

There are two types of rates used to calculate the VAT applicable on goods and services: the standard rate and the zero rate.

The standard rate was increased from 15% to 18%, effective January 2024. Currently, this applies to all taxable goods and services, except for financial services and the special cases noted below.

| Types of VAT rates | Applicable to | Rate |

| Standard rate | Goods or services other than exempt or zero-rated supplies | 18% |

| Standard rate | Financial Services | 18% |

| Standard rate | Direct exporters and importers are liable | 18% |

Digital & cross-border services (new): from 01 October 2025, services supplied by a non-resident through an electronic platform to a Sri Lankan customer are subjected to the standard 18% VAT. Non-resident suppliers (or appointed local withholding agents) must register and file.

Zero-value supplies (new): Employer-provided meals and home-to-work transport offered free or at a concessionary rate: specified reinsurance commissions; and the face value of unused Government or Provincial council postage/revenue stamps are treated as having a value of zero for VAT from 01 January 2024.

Further, the removal of the VAT exemption on Condominium Residential Apartments will be effective from the 1st of January 2024.

What are the goods exempted from VAT?

To find the complete list of goods and services currently exempt from VAT in Sri Lanka, refer to the Value Added Tax Act, No. 14 of 2002, as amended by the Value Added Tax (Amendment) Act, No. 04 of 2025.

Additional items brought in by the 2025 Amendment

- Locally-produced liquid milk and yoghurt (effective 11 April 2025)

- Chemical naptha supplied by CPC to the CEB for power generation (effective 11 April 2025)

- Import of aircraft engines & spare parts – exemption applies only to imports made before 11 April 2025

How to calculate VAT?

- The VAT applied for taxable goods or services can be calculated by multiplying the price of a product or service by its applicable VAT rate divided by 100.

As an example:

VAT = A x (B / 100), A is the product/service to which VAT is applicable in Sri Lanka. B is the applicable rate of VAT associated with the product/service in Sri Lanka. - To find the total VAT to be paid for a month, you must deduct the total output tax (the VAT charged during sales) from the total input tax(the VAT paid during purchases) for the month.

VAT Payable = Output Tax – Input Tax

When should you pay VAT?

Every VAT registered business must make the payments within the provided period or before the following month’s due date to avoid penalties. The scheduled dates and periods are as follows;

You can make the VAT payments to the Inland Revenue Department through any branch of the Bank of Ceylon (BOC).

Type of Taxable Supply or Service | Period to make payments | Due Dates |

| On all Supplies, including manufacturers and financial services | Monthly basis (end of the month) | On or before the 20th of the following month. |

You can make the VAT payments to the Inland Revenue Department through any branch of the Bank of Ceylon (BOC).

In addition, you can make payments through the Online Tax Payments Platform (OTPP). For further details, please refer to Public Notice Number PN/PMT/2021 dated 08.06.2021 (Revised) dated May 17, 2022, PN/PMT/2022 .01 or log into IRD’s web portal for the user guide.

What are the additional obligations of a VAT registered person?

A VAT registered business also has other responsibilities in addition to making sure the relevant VAT is paid to the government. They are also required to:

- Display the certification of VAT registration at a visible place on business premises.

- Keep accounts for the relevant periods.

- Submit VAT payments and the VAT returns before the due dates.

- Inform the IRD if there are any changes to the name, address, ownership, and nature of the business.

- Issue tax invoices when doing transactions with other VAT-registered companies, including the following information.

- Date of Invoice and Serial No.

- Name of the supplier, address, and VAT registration number

- Name of customer, address, and VAT registration number

- Date of supply, description, and quantity.

- The value, amount of VAT charged, and the consideration of the supply

- The wording of ‘TAX INVOICE’ should be shown at a prominent place on the invoice.

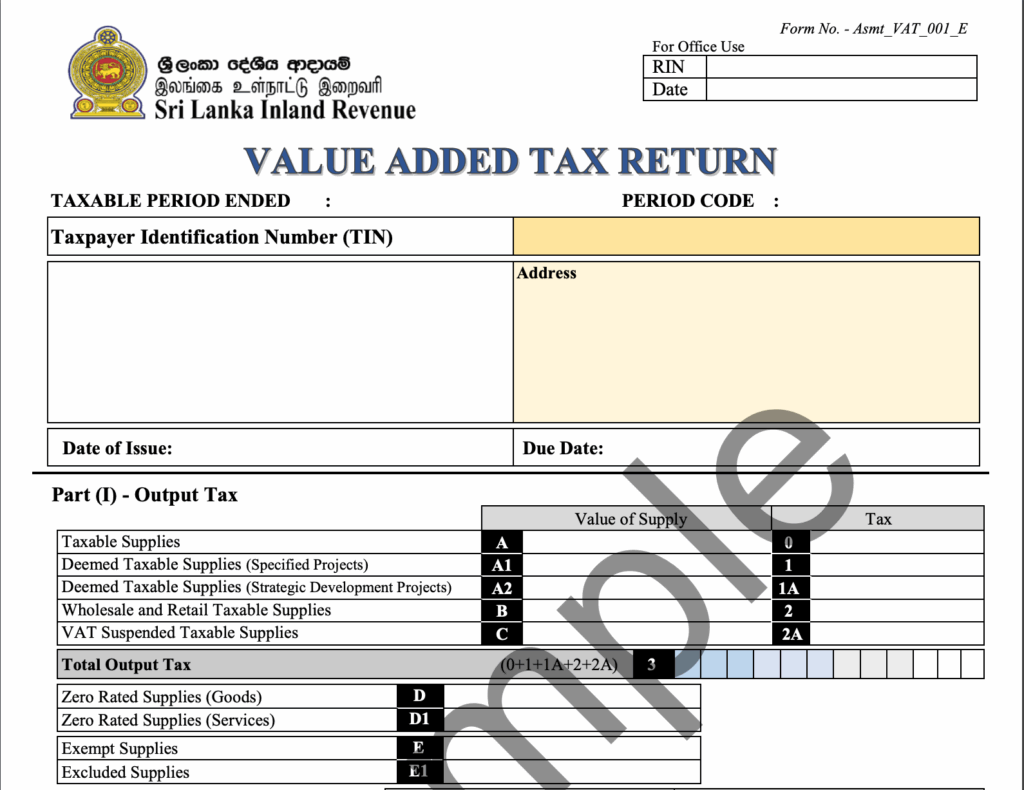

What is a VAT return, and how to submit it?

A VAT return summarises your business’s supplies, purchases, input VAT and output VAT for the relevant taxable period, showing both tax payable and whether you are due a refund. Depending on your filing frequency-monthly or quarterly-you must submit the return by the 30th and settle any VAT due by the 20th (every month for monthly filers, or in the month after the quarter ends for quarterly filers). You can lodge the return in person or by post to IRD’s Central Document Management Unit (CDMU) or submit it online through the IRD e-service portal.

Who is eligible for a VAT refund?

A VAT refund is issued when a business has an excess of input VAT carried forward at the end of the month. Below is an example of how ‘Input VAT’ is carried forward.

- Rohan has a business where he exports toys directly to international customers.

- During a taxable period, Rohan bought raw materials that had a total input VAT of Rs.. 100,000.

- However, Rohan did not charge VAT for the toys he sold because direct exports have a 0% VAT rate. Therefore, the total amount of output VAT is zero.

- Then the total amount of VAT that Rohan should pay to the government is equal to output VAT – input VAT, which is Rs. -100,000.

- This negative amount is known as an excess of input VAT

However, every business with an excess of input VAT is not eligible for a refund. The following is a list of types of companies qualified to receive VAT refunds. (Inland Revenue Department)

- Exporters and zero-rated suppliers are entitled to refunds within 45 days.

- Manufacturers who manufacture and supply goods to exporters

- Value-added service providers who provide services to exporters

- A project approved by the Commissioner-General of Inland Revenue under section 22(7) of the Value Added Tax Act No 14 of 2002 during the project implementation period is entitled to refunds within 45 days.

- Suppliers who provide goods or services to a specified project or a Strategic Development Project under the Strategic Development Projects Act No.14 of 2008.

How to obtain a VAT refund?

In order to obtain a VAT refund without, the below process should be followed.

1. You must submit the VAT return before the due date with the following information to the correct office.

- Input VAT applied on imports and local purchases during the period

- Amount of exports and suspended sales during the period

Returns in respect of specified projects or Strategic Development Project should be submitted to the Senior Commissioner (VAT) on the 2nd floor of IRD Building. All other returns should be submitted to the DPRA unit on the 7th floor.

2. Ensure the following is correctly mentioned on the VAT return documents.

- Input VAT on imports during the period.

- Input VAT on local purchases during the period.

- Amount of exports during the period.

- Amount of suspended sales during the period.

3. The below documents should be kept with you until the VAT Refund Unit asks you to submit these.

- a schedule of imports (deferred and upfront) with original cus-decs for the relevant period.

- Export Schedule – where return exports data match with custom data or difference below 10% of declared exports.

- Export reconciliation – where return export data does not match with custom export data or the difference is above 10% of declared exports.

- Local purchases schedule with original tax invoices for the relevant period.

4. An authorized representative of the business will verify the submitted documents.

5. Before the refund is issued, the following requirements also have to be completed.

- Suspended sales confirmation

- Place visit done by the refund officer to verify the business place.

- Tax clearance certificate.

- Details of correct bank account.

Provided the details and reports are accurate, the IRD will issue a cheque to the given bank account holder’s name and a credit voucher under the registered person’s name. The above process is also available through the Inland Revenue department website.

How can Simplebooks help?

This article provides everything you need to know about VAT Sri Lanka. Using the steps provided in this article, you can easily make all your VAT obligations without a hassle. However, if you need any further information or guidance, get in touch with us today for a free personal consultation

FAQs

The standard VAT rate for goods and services is 18%.

The VAT applied for taxable goods or services can be calculated by multiplying the price of a product or service by its applicable VAT rate divided by 100. VAT = A x (B / 100) A is the product/service to which VAT is applicable in Sri Lanka.

Businesses with a yearly turnover of LKR 60 million or a quarterly turnover of LKR 15 million need to register for VAT, starting January 1st, 2024.