Do you have to file a tax return? You may have questions about whether you have to pay and file taxes. However, after reading this blog, all your questions regarding Corporate taxes will be answered. You’re in the right place to stay ahead in the corporate tax landscape. Let’s explore corporate tax in Sri Lanka to get a better understanding using current information.

What is corporate tax?

You are required to pay corporate income tax on your company’s net profit, that is, “The profit remaining after deducting all allowable business expenses” (Taxable income)

Paying your taxes is not just a legal obligation; it also contributes to building a stronger nation and creating a better future for the next generation.

Who needs to pay Corporate Income Tax?

If there’s profit involved, the tax may be applied. If your business fits into one of the following categories, you are liable to pay corporate income tax on your profit.

(a) Limited liability company (Resident or non-resident)

(b) trust (Resident or non-resident)

(c) Charitable institution

(d) Unit trust or mutual fund

(e) Non-governmental organization

(f) Public corporation

(g) Club, society, or association

(h) Any government organization

(i) Employees’ Trust Fund, Provident Fund, Pension Fund, Termination Fund, or Gratuity Fund

(j) Any other entity, excluding a partnership

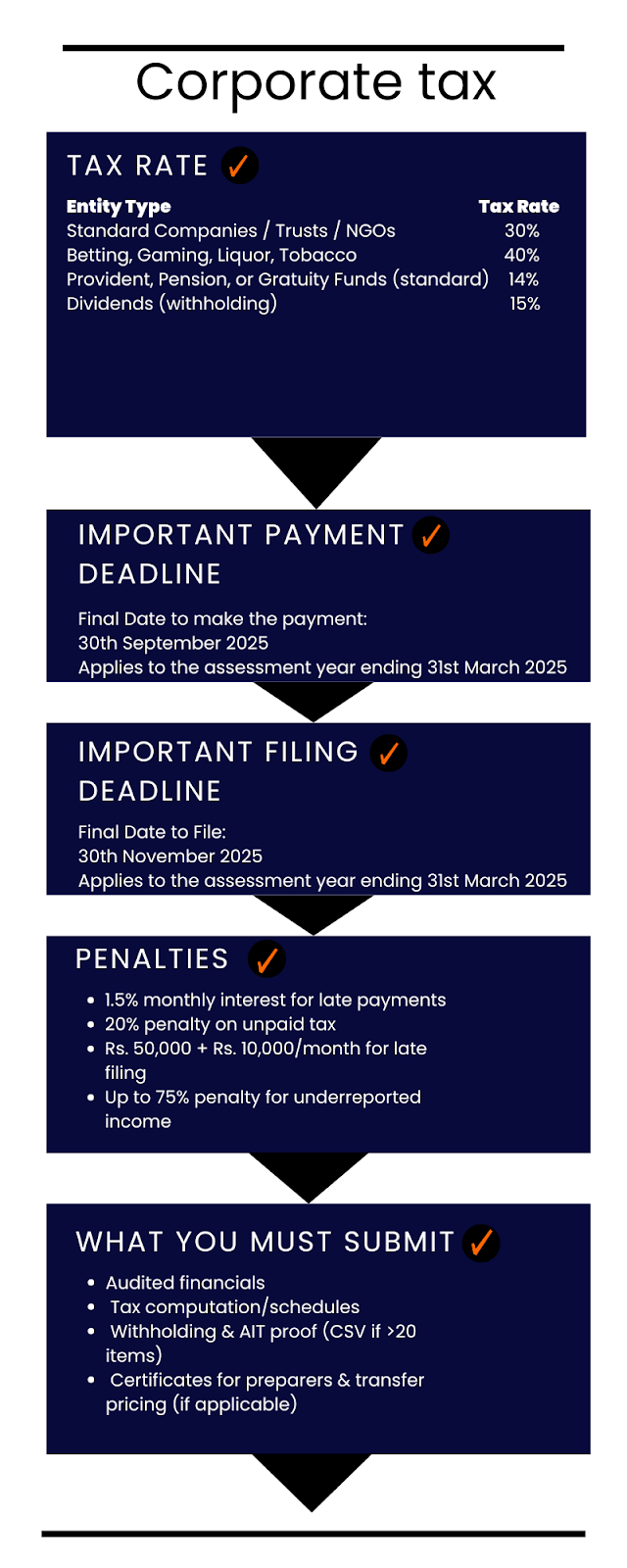

Corporate Tax Rates in Sri Lanka (2024/2025)

Now, let’s talk about numbers. As a business owner, understanding your tax rate is key to staying ahead. Take note that the standard corporate tax is 30% but it can vary depending on the type of business and industry. Always check your industry and income type with the IRD to know the exact rate that you will have to pay.

| Type of Business | Tax rate |

| Companies | 30% (Standard) |

| Trust | 30% |

| Unit Trust and Mutual Fund | 30% |

| Non-Government Organizations (including amounts received by way of grant, donation, contribution, or any other manner under section 68 of the IRA) | 30% |

| Betting & Gaming | 40% |

| Manufacture and sale, or import and sale of any liquor or tobacco product | 40% |

| Tax Rate for Employee’s Trust Funds, Provident, Pension or Gratuity Funds, and Termination Funds. | 14% (standard) / 30% (certain income) |

| Dividend | 15% |

Now, based on the industry’s rate, if you’re liable to pay tax, the next step is to pay the taxes on time. Register with the IRD, find out your rate, and follow the steps to pay on time. No need to worry, it’s easier than you think.

How to compute the Taxable profit

You might think that taxable profit is the net profit computed from the Income Statement. NO, taxable profit is calculated by adding all the disallowable expenses and deducting all allowable expenses from your net profit. Sounds confusing? Let us explain the Allowable expenses and Disallowable expenses in this section.

| Adjustment/Detail | (+) | (-) |

| Accounting profit before tax | XXXX | – |

| AdjustmentDisallowed expenditure | XXX | – |

| Adjustment Income or Taxable expenses | XXX | XXX |

| XXXX | XXX | |

| Adjusted Profit/(Loss )for tax purposes | XXXXX |

Allowable expenses (Section 10)

There are some expenses that you have not deducted as expenses in your company’s Income Statement. However, those expenses are deducted from your net profit when calculating Taxable Income. Such expenses are known as Allowable expenses. The following are the Disallowable Expenses.

- Domestic expenses (Sec. 197).

- Tax payable under this Act and taxes or other levies specified by the CGIR

- Interest, penalties, and fines payable for breach of any written law in any country,

- Expenditure incurred in deriving exempt or final WHT amounts,

- Retirement contributions (by the employer): (if the benefit is taxed on the employee or contributed to a fund approved by the CGIR, such contributions are allowed)

- Dividends of a company,

- Entertainment expenses or outlays,

- Reserves or provisions,

- Expenses incurred on lotteries, betting, or gambling, unless in the course of conducting such a business.

- Payment for which the person is required to withhold tax, deduction shall not be allowed for the respective expenditure until the tax is paid

Disallowable Expenses

There are some expenses that you have deducted from your company’s Income Statement. However, those expenses can be added to your net profit when calculating Taxable Income. Such expenses are known as Disallowable expenses. The following are the Allowable Expenses.

- Interest Expenses (Section 12)

- Allowance for trading stocks (Section 13)

- Repairs and improvements (Section 14)

- Research and Development expenses and agricultural startup expenses (Section 15)

- Capital allowances and balancing allowances (Section 16)

- Losses on realization of business assets and liabilities (Section 17)

- Deductible amount of financial cost (Section 18)

- Business or investment losses (Section 19)

Check out the IRD Act for further clarification.

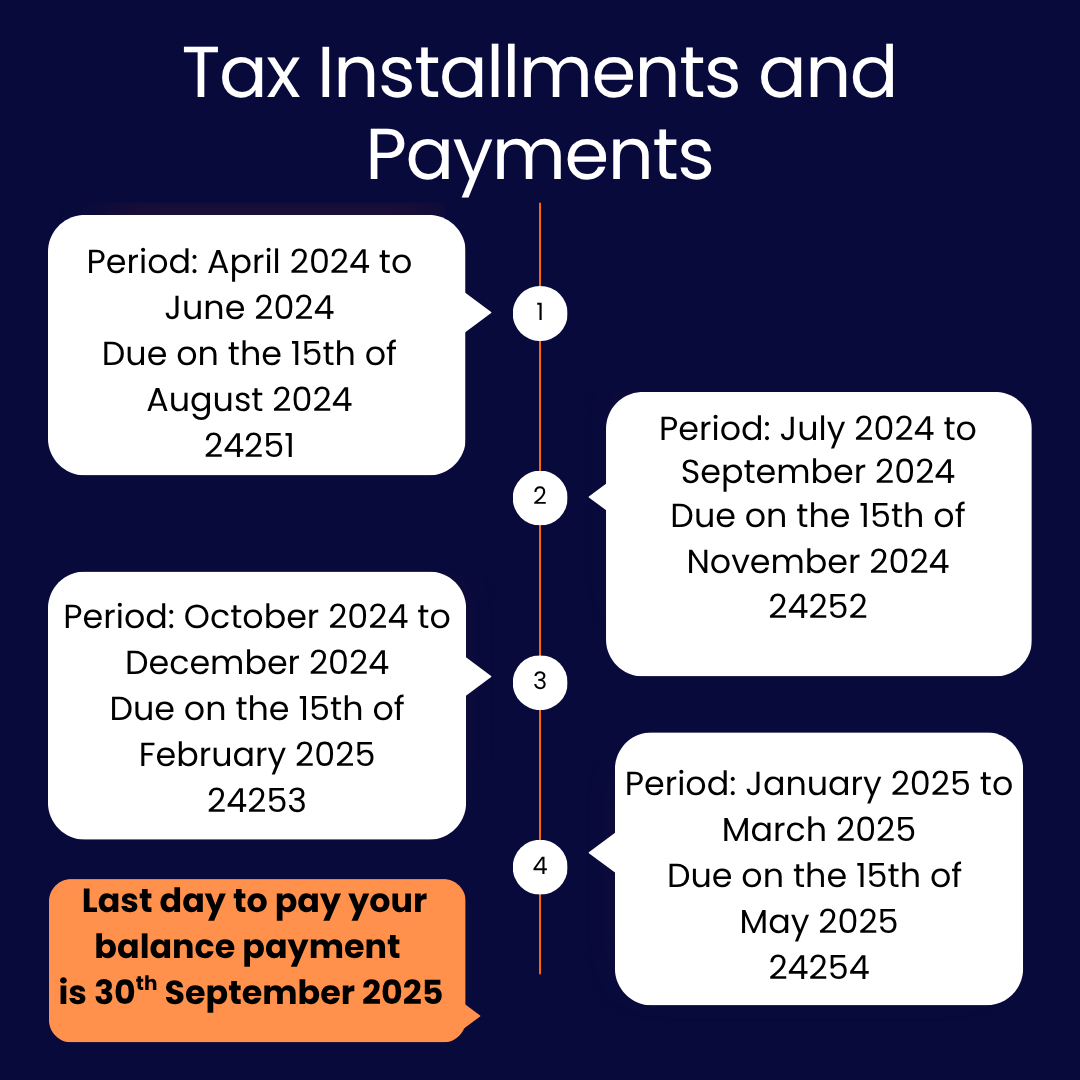

Tax Installments and Payments

Mark your calendar, because staying ahead starts with knowing your important deadlines. You can pay your tax by breaking it down into smaller, easier payments throughout the year in quarterly installments for the 2024/2025 assessment year.

| Installment | Time Period | Due date (On or before) | Payment Code |

| 1 | April 2024 to June 2024 | 15th of August 2024 | 24251 |

| 2 | July 2024 to September 2024 | 15th of November 2024 | 24252 |

| 3 | October 2024 to December 2024 | 15th of February 2025 | 24253 |

| 4 | January 2025 to March 2025 | 15th of May 2025 | 24254 |

| Balance Payment (last day to pay) | For the year ending 2024/25 | 30th September 2025 | 24250 |

Tax Filing: When & How

When to file your taxes

You have to file your corporate income tax every year without fail. You need to submit your return on or before 30th November 2025 for the financial year ending 31st March 2025 (2024/25 assessment year).

However, submitting early will make life easier for both you and the Inland Revenue Department (IRD), so don’t wait till the last minute!

How to file your tax return

Do you know that now you need no more paper forms? You have to pay your taxes online via the IRD website and use their e-filing system (Electronically filing returns). And it is a must to apply via the IRD’s e-filing system. It’s simple and efficient! Everything is set up and easy for you to log in and submit everything electronically.

If you want to get more information on Corporate Income Tax filing, click here.

Submission of the returns

You can now easily submit your completed tax return and all the necessary documents online using the IRD’s e-filing system. Just visit their website, upload everything, and you’re done. There’s no fuss and no stress!

You have to file through e-filing, which is mandatory for all corporate taxpayers, and use the IRD portal: E-services-log in for companies.

(i) Audited financial statements

(ii) Tax computation statement or Schedule 8 of the specified forms

(iii) Withholding tax or Advance Income Tax (if claimed), verified schedules on CSV format (uploading is compulsory if the number of items is more than 20)

(iv) Separate certificates of the person who prepared the return or part of the return for a payment

(v) Transfer pricing disclosure form in PDF/JPG with Excel format (if applicable)

(vi) Any other required documents and certificates

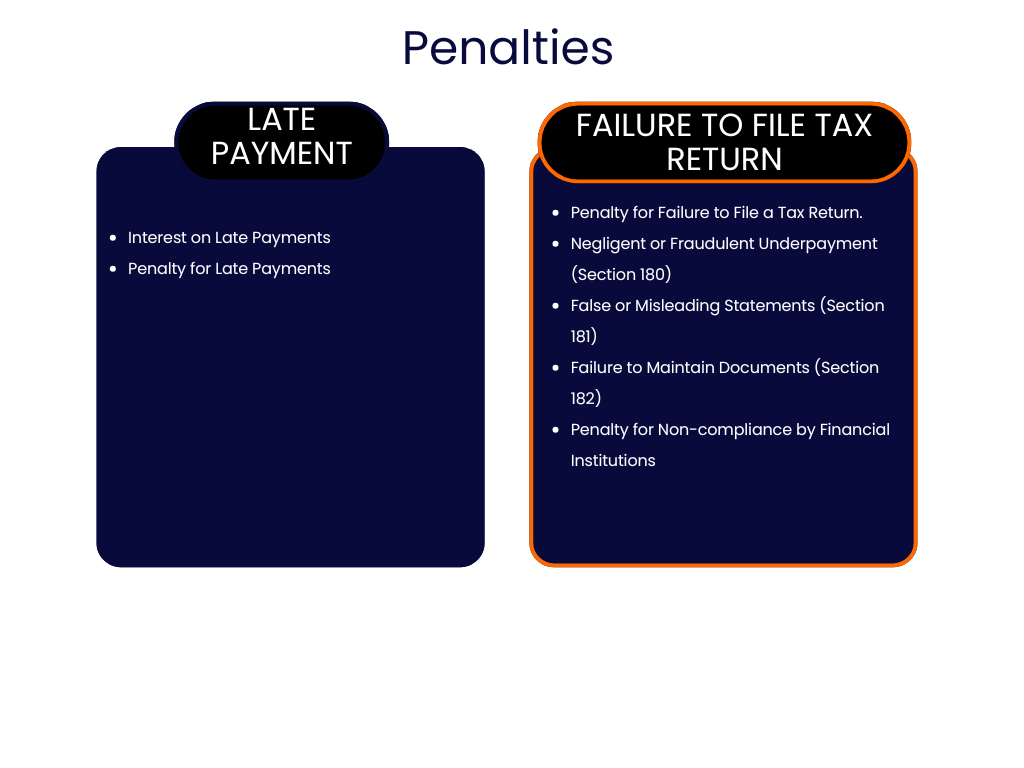

Penalties You Don’t Want to Face

Here’s what happens if you miss a deadline or make a mistake. Remember this one! Making late payments or failing to file tax returns will make you pay penalties. But the good news is that penalties can be completely avoided by proper planning and timely action. Let’s see how IRD imposes penalties for late payments and failing to file tax returns.

Penalty for late payments

- Interest on late payments: If you fail to pay the tax by the due date, you will be charged an interest of 1.5% per month (or part of the month) from the due date until the tax is paid.

- Penalty for late payments: If you fail to pay the tax fully, a penalty of 20% will be charged for the unpaid tax. In addition to that, if you missed the installment payments, a penalty of 10% will be charged on the unpaid tax amount.

Example:

Lotus Creations (Pvt) Ltd paid Rs. 300,000 before the due date of their Rs. 500,000 tax bill. They plan to pay the remaining amount later. They also completely missed their third-quarter installment.

Penalties Applied:

- 20% on Rs. 200,000 unpaid = Rs. 40,000

- 10% on missed installment (say Rs. 125,000) = Rs. 12,500

Total Penalty: Rs. 52,500

Penalty for failure to file

- Penalty for Failure to File a Tax Return: If you fail to file a return by the 30th of November 2025, it will result in a penalty equal to the greater of;

5% of the amount of the tax owing, plus a further 1% of the amount of tax owing for each month (or part of a month) for which the filing is delayed; or

Rs. 50,000/- plus a further Rs. 10,000 for each month or part of a month during which the filing is delayed

Example:

Sahan’s Hardware failed to submit its 2024/2025 return by November 30, 2025. They are liable to pay a tax amount of Rs. 1 million and delay filing until February 15, 2026, which was over 2.5 months late.

Penalty Option 1:

5% of Rs. 1 million = Rs. 50,000

1% × 3 months = Rs. 30,000

Total: Rs. 80,000

Penalty Option 2:

Rs. 50,000 + Rs. 10,000 × 3 = Rs. 80,000

Whichever is higher applies: Rs. 80,000

Filing late can be expensive. Set reminders to file before November 30.

- Negligent or Fraudulent Underpayment (Section 180): If someone underpays taxes intentionally or negligently due to incorrect statements or omissions, a penalty will be imposed. If the underpayment exceeds Rs. 10 million or 25% of the taxpayer’s total tax liability, a penalty of 75% is applied. Otherwise, the penalty is 25% of the underpayment.

- False or Misleading Statements (Section 181): If someone made false or misleading statements to tax officials, a penalty of Rs. 50,000 or a higher amount is imposed based on the tax that would have been assessed or the refund reduced.

- Failure to Maintain Documents (Section 182): If someone fails to maintain proper documents, a penalty of Rs. 1,000 per day applies

- Penalty for Non-compliance by Financial Institutions: A penalty up to Rs. 50,000 applies when a financial institution fails to comply with procedures specified by the Commissioner General.

Disclaimer: The final decision on the penalty is made by the IRD Commissioner.

Incentives and concessions

BOI and Strategic Development Project Concessions

If you are doing a project under BOI( Board of Investment, you may qualify for,

- 5 to 15 years of Full tax exemption

- Reduced tax rates by 2% to 5% for an additional 15 years

- Exemption from WHT on Foreign personnel salaries and dividends

25 years of tax holidays you can get for Strategic Development Projects

Next Step

Understanding your taxes is just the beginning. Here’s how you can move forward with confidence. Paying corporate tax is not hard. You just need to be prepared. Remember, you have the tools. You now also know how to make better tax decisions for your business.

If you plan and know what to do, it becomes a simple step in running your business.

To avoid penalties and keep things running smoothly, make sure you know the deadlines and requirements. Staying updated makes everything easier!

For official resources, visit the Sri Lanka Inland Revenue Department

Consult a Tax Expert Today

Don’t miss the opportunity to reduce your tax liability through effective planning. Maximize your tax efficiency with expert guidance – Book a free consultation now!

If you need corporate tax computation and return submission or would like to review some effective corporate tax planning strategies, you can get the service today. We will help you get your company tax-compliant according to Sri Lanka’s laws and maximize its tax efficiency.

If you need help with managing your taxes better, visit SimpleBooks Income Tax Services.

Want to know more about Income Tax? Visit our Guide on Income Tax in Sri Lanka.

Also read Sri Lanka’s 2025 Tax Reforms.

FAQ on Corporate Tax in Sri Lanka

Common Mistakes

Late filing or missing deadlines

Heavy penalties will result when filing after the deadline on November 30, 2025. (Rs. 50,000 + Rs. 10,000 per month).

Not using the e-filing system

E-filing is mandatory for all corporate taxpayers as of the Year of assessment 2024/25.

Incorrect tax rate selection

Applying the wrong corporate tax rate, for example, using 30% standard instead of 40% for liquor businesses.

Omitting disallowable expenses

Including non-deductible items like penalties, fines, or entertainment expenses can inflate deductions.

Missing supporting documents

Not submitting audited financials, tax computation schedules, or transfer pricing disclosures if applicable.

How to Avoid Them:

*Manage a set of reminders and a tax calendar

*Use the IRD’s e-filing portal as required.

*Refer to the tax rate tables for your business type or confirm with a tax advisor.

*Double-check all allowable and disallowable expenses.

*Ensure all schedules and supporting docs are attached before submission.

Retained earnings themselves are not taxed, and they are after-tax profits retained in the business rather than distributed

However,

*If reinvested, they may lead to future deductible expenses or capital allowances.

*If declared as dividends, a 15% final withholding tax applies to the dividend amount as per Section 12.2 of the guide

*Retained earnings do not reduce your taxable profit for the current year

In essence, you are taxed on net profit, regardless of whether it is distributed or retained

Yes, you need to pay quarterly installments under Section 90 of the Inland Revenue Act. Calculation, Installments are usually based on the previous year’s tax liability or estimated current year income, excluding gains from investment asset realization. Failing to pay installments on time leads to a 10% penalty on unpaid amounts.

Foreign income and cross-border dealings have specific tax implications,

Global Income Basis

Resident companies are taxed on worldwide income, including foreign income.

Withholding Tax

Some foreign payments may require withholding tax compliance depending on the DTA (Double Taxation Agreement) with the respective country.

Transfer Pricing

If your business engages in transactions with associated entities abroad, you must submit a Transfer Pricing Disclosure Form (TPDF) with your tax return.

Relief for Double Taxation

Under Sections 77 and 88 of the IRA, relief may be available for taxes paid abroad if a DTA exists.

Ensure you maintain all related documents and consult a tax expert for proper structuring and compliance.