Registering your company is the first and most important step of starting a business.

But that’s not all you need to do.

Once you register, there’s a few other things left to take care of like:

- Post registration compliance

- Open a tax file

- Maintain bookkeeping records

- Compute tax and file annual returns

On this blog, we’re going to specifically talk about filing annual returns through form 15.

What are Annual Returns and Form 15?

18 months after incorporating (registering) your company, you need to file your Annual Returns to the Registrar of Companies.

But what exactly are Annual Returns?

Well, it’s not exactly a financial document.

It’s more like a yearly update of your company’s:

- Current management and ownership

- Changes made within the past 12 months

The ROC uses this information to make sure that your company’s information is up-to-date.

This is why filing annual returns is so important.

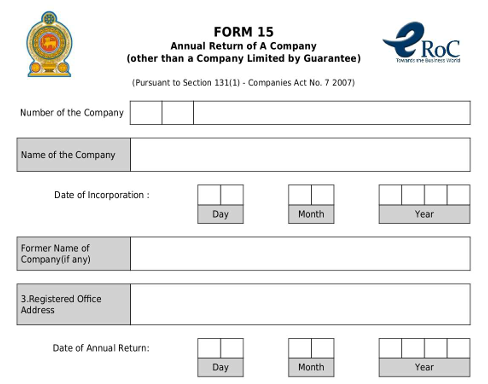

You use Form 15 to officially file in your Annual Returns.

What is Form 15?

Form 15 is the document used to file Annual Returns.

You can download this form through the eROC or here.

We’ll go into depth about Form 15 in this blog.

Is it mandatory to file Annual Returns?

Yes, it is.

Under Section 131 of the Companies Act No. 07 of 2007, you need to file annual returns if you own a Limited Company.

What do I include in Form 15?

When you register your company, you include all your public information like your company’s:

1. Address

2. Directors

3. Shareholder

4. Auditors

5. Shares

If there’s any change made to this information, you have to mention it when you’re filing in your Annual Returns.

Once Form 15 is completed, it has to be submitted to the ROC within 30 days of the last AGM that was held by your company.

When do I file in Form 15?

You need to file your first Annual Return 18 months after you have registered your company.

After that, you need to file them every 12 months.

All annual returns (Form 15) must now be filed electronically through the official eROC website.

How do I file Annual Returns in Sri Lanka?

Filing your Annual Returns in Sri Lanka is a two-step process:

Step 01 – Hold an Annual General Meeting (AGM)

Step 02 – File Form 15

Let’s take a look at these steps in detail.

Step 01 – Hold an Annual General Meeting (AGM)

An AGM is a compulsory yearly meeting every Limited Company needs to hold.

The Board of Directors are responsible for holding the AGM every year.

Here, the Directors will present an annual report about the company’s performance and work strategy to the Shareholders.

The shareholders will vote on the current issues of the company.

These issues can range from:

- Appointments to the board of Directors

- Dividend payments

- Executive compensation

- Selection of auditors

and etc.

Holding the AGM is the first step to filing Annual Returns.

Important things to remember,

The first AGM after registering your company has to take place within 18 months.

After the first AGM, every other AGM has to be held within 12 months.

You also have to hold your AGM:

- Within 6 months from the balance sheet

- Before 15 months after the last AGM.

If you’re unable to hold an AGM,

- The Directors of the company have to pass resolutions regarding all issues that were supposed to be discussed during the AGM.

- 85% of the shareholders have to sign these resolutions.

- Afterwards, the resolutions have to be submitted to the ROC with the Form 15.

- This Resolution must be signed by 85% of the shareholders and then submitted with the Form 15 to ROC.

Step 02 – File Form 15

Once you either:

- Hold an AGM

OR

- Pass resolutions (if you’re unable to hold an AGM)

all that’s left to do is fill in and submit Form 15 within 30 working days of this.

The Board of Directors are responsible for filing this document.

Remember, all the details need to be printed. The Registrar of Companies does not accept hand written forms.

You can now file your annual return entirely through a digital process. It is described as follows,

eROC account setup: Directors and company secretaries must have individual user accounts on the eROC portal. The companies that registered before the launch of eROC system must first be “connected” to those user accounts by submitting a request to the ROC.

Online preparation: The company secretary or director must log in to the eROC account to prepare the annual return by filing in the required information directly on the portal.

Download & Sign: The eROC system generates the completed form 15. This official form must be downloaded and physically signed by both the director and the company secretary.

Upload & Pay: The scanned, signed form must then be uploaded back to the eROC portal, and the statutory fees must be paid online to complete the submission.

Here’s how you fill in Form 15.

Part 01 – Fill in Company details

You need to fill in your:

- Company number

- Company name

- Date of incorporation

- Registered address

- Date of annual return

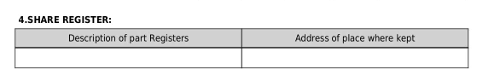

Part 02 – Mention Company shares

You only need to fill this part in if your share register is divided into 2 or more registers.

Remember, these registers also need to be kept in different places.

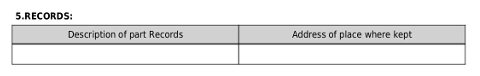

Part 03 – Include company record information

Again, you only need to complete this section if any of the records are not kept at the company’s registered office.

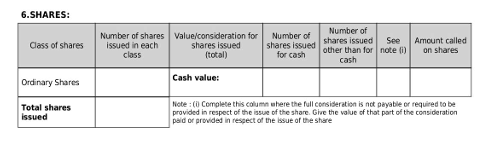

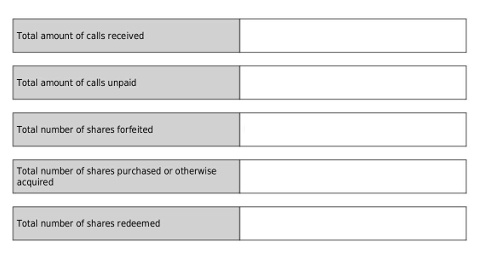

Part 04 – Include share details

You can mention or update all information regarding shares issued by the company here.

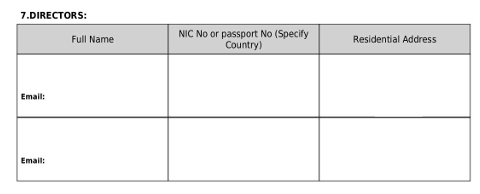

Part 05 – Include details of Company Directors, Secretaries and Auditors

Directors

Include or update:

- Full name

- NIC or Passport number

- Residential Address

of your existing and new directors.

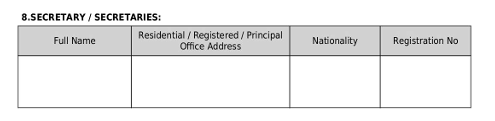

Secretaries

Include or update:

- Full name

- Address

- Nationality

- Registration number

of your existing and new secretary/secretaries.

Useful additional links: Here’s how you can choose the perfect company secretary for your business

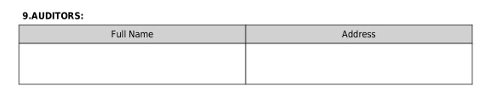

Auditors

Include or update:

- Full Name

- Address

of your existing or new auditors.

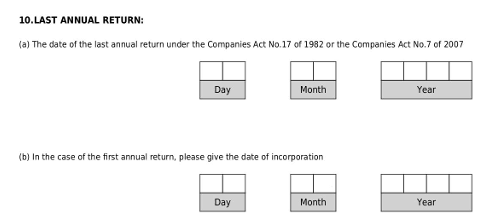

Part 06 – Mention details of your previous Annual Return

Here you need to mention the date of the last Annual Returns.

In case this is the company’s first time filing Form 15, the date of incorporation/registration has to be mentioned.

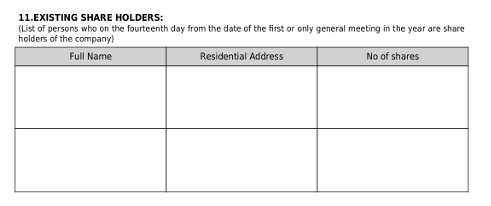

Part 07 – Information of Existing and Past Shareholders

Existing Shareholders

Enter the:

- Full name

- Residential Address

- Number of share held

by the persons that were listed as shareholders since the 30th day of the AGM.

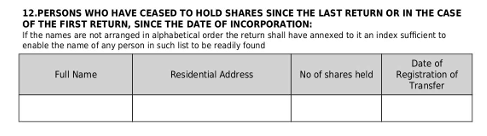

Past Shareholders

Here, you can mention the:

- Full name

- Residential Address

- Number of shares held

- Date of registration of Transfer

of the people who are no longer shareholders of the company since the last Annual Returns were filed or since the date of registration.

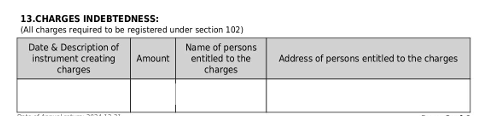

Part 07 – Charges

If you have registered for charges under section 102 of the Companies Act No. 07 of 2007, you have to mention:

1. Date and Description of the instrument creating charges

2. Amount paid

3. Name and Address of persons entitled to the charges

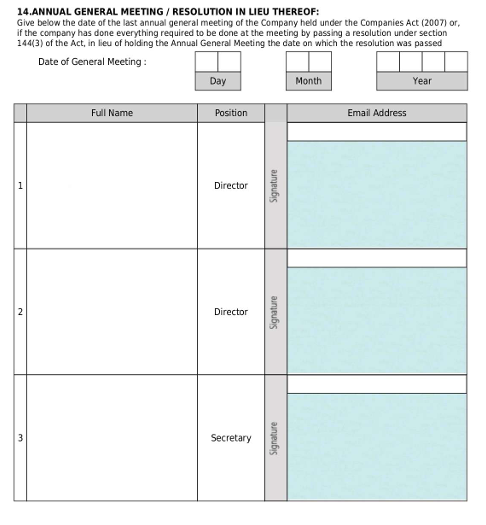

Part 08 – Date of AGM/Resolution

This section is to prove that an AGM was conducted by your company or a Resolution was passed instead. For this the date of the meeting or Resolution must be mentioned along with the signatures of a Director and the secretary/ secretaries.

This section is to prove that you held either an AGM or passed a resolution during the current financial year.

You have to mention:

- Full name of Director

- Full name of Secretary

- Signature of Director

- Signature of Secretary

in this part.

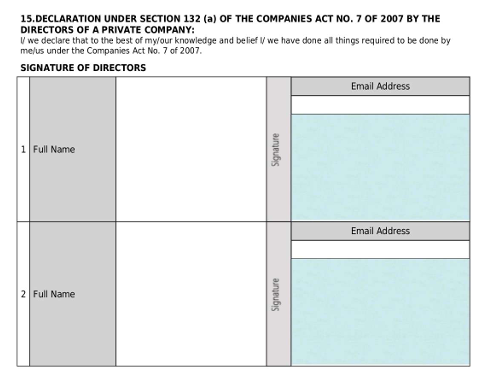

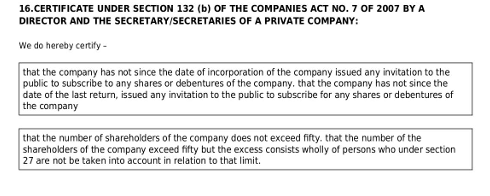

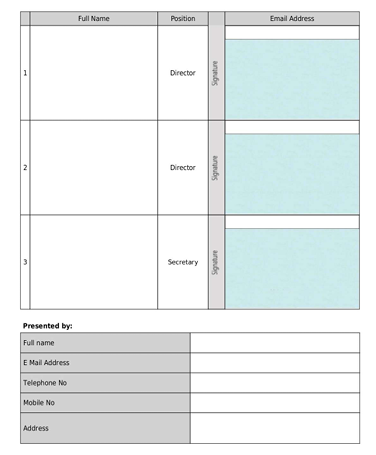

Part 09 – Details of Private Limited Company

You only have to fill in the next two sections if you own a Private Limited Company.

Section 01

Here, the directors declare that all the legal procedures in their company were conducted under the Companies Act No.7 of 2007

Section 02

This section certifies that:

- The public was not invited to subscribe to any shares of the company

- There is a limit of 50 shareholders in the company

What happens if I don’t file Form 15 in Sri Lanka?

If a company fails to file Annual Returns in Sri Lanka, the company will:

- Face up to Rs. 100,00 or more in fines

AND

- Each Director will face a fine not exceeding Rs. 50,000

File your Annual Returns with Simplebooks!

If you’re a new company that needs help filing your Annual Returns or if you have a really busy schedule, Simplebooks can help.

We’re a registered company secretary that can file your annual Annual Returns the right way at the Registrar of companies, ensuring compliance with the Sri Lankan laws.

Simplebooks will:

- Prepare your Annual Returns statements

- Complete Form 15

- Ensure your company’s filing is done in compliance with the laws

FAQs

Yes.

If you are an owner of a registered limited company in Sri Lanka, it is compulsory to file in Annual Returns.

This is explicitly stated in the terms of Section 131 of the Companies Act No. 07 of 2007.

If Annual Returns are not filed, there will be a fine imposed on your company. Each Director will face a fine not exceeding Rs. 50,000.00 and the company can face a fine upto Rs. 100,000.00 or more.

The Directors of your company should fill this form after the AGM.

It should be printed. The ROC does not accept handwritten documents.

You can download the form from the eROC.

Once you complete the form, submit it to the ROC within 30 days of the AGM.

Read a detailed guide on how to file form 15 here.

A company has to call an AGM of Shareholders once every calendar year (12 months).

For this purpose, the AGM should be held:

1. Within 6 months from the balance sheet

2. Before 15 months from the last held AGM

If you’re a new company, your first AGM should be held within 18 months of incorporating (registering).

If a company fails to file Annual Returns in Sri Lanka, the company will:

1. Face up to Rs. 100,00 or more in fines

AND

2. Each Director will face a fine not exceeding Rs. 50,000

To avoid the fines, the Directors of the company can agree to pass a resolution instead.

The resolution should include all matters required to be taken up at the AGM.

It should also have signatures of 85% of the shareholders.

If your NGO is incorporated as a Company Limited by Guarantee, you have to file Annual Returns through Form 15A.

You can download this form here.

Step 01 – Hold an AGM or pass a board resolution.

Step 02 – Submit Form 15 to the Registrar of Companies.

Read our detailed guide on how to file Annual Returns here.

It’s compulsory to file your Annual Returns on time.

If they’re late, your company will be charred a penalty.

To avoid this you must file in Annual Returns within 12 months of the last filing date.

If it is the first filing, then it must be done within 18 months of incorporating your company.