Updated 2024

You have your business idea, your company is registered, and now, you’re trying to figure out how to get a Tax Identification Number in Sri Lanka for your company.

You’re just a few steps away from running a fully functional business! We’ll take you through the process, and by the end of this blog, you’ll be equipped to get your TIN Number.

A Taxpayer Identification Number (TIN) is issued by the Inland Revenue Department (IRD) of Sri Lanka to register your business as a taxpayer. It is used to keep track of its taxpayers and optimise the process of tax compliance.

Let’s take a look at the steps you can take to obtain a TIN number for your business.

According to a recent announcement by the Sri Lankan Finance Ministry, Income tax registration became compulsory for everyone above 18 years as of April 1, 2024. While mandatory registration applies to all, not everyone registered will be required to pay taxes. The government clarifies that only those earning more than Rs. 100,000 per month will actually pay income tax.

But even if your income isn’t high enough to be taxed, getting a Taxpayer Identification Number (TIN) is important. You’ll need it for everyday things like:

Here’s a step by step guide on how to obtain your Tax Identification Number in Sri Lanka:

First, obtain the appropriate application form from the Taxpayer Services Unit (TPSU) at the IRD Head Office or download it here. Depending on the type of business you’ve registered as you may require different additional documentation:

Remember: You must have photocopies of all your documents along with the originals.

Useful links:

http://www.ird.gov.lk/en/Shared%20Documents/TPR_Guidelines_1.1_E.pdf

http://www.ird.gov.lk/en/Shared%20Documents/TPR_Guidelines_E.pdf

Now that you’ve gathered all the essential documentation to apply, the next step would be to decide on a mode to obtain your TIN certificate. There are three ways to obtain your TIN number:

Let’s take a deeper look at how you can register for your Taxpayer Identification Number through each method.

Have you figured out which type of business you’re going to register as?

We’ve got you covered either way!

Here’s how you can register as a corporate taxpayer.

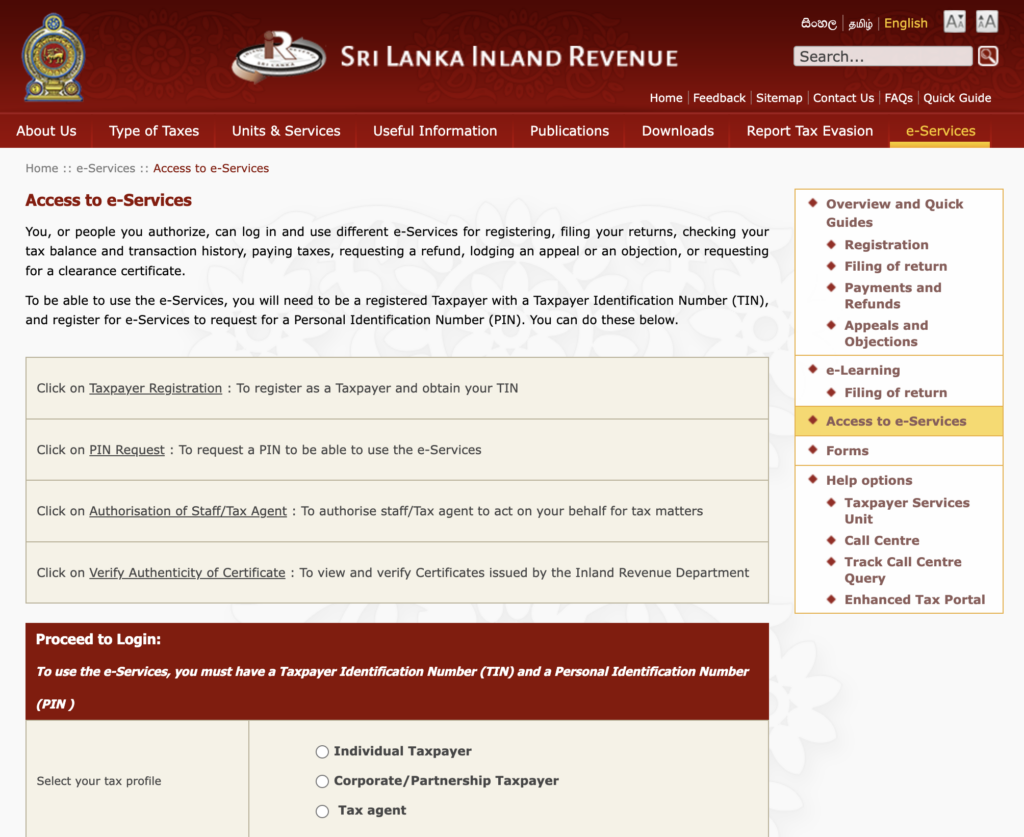

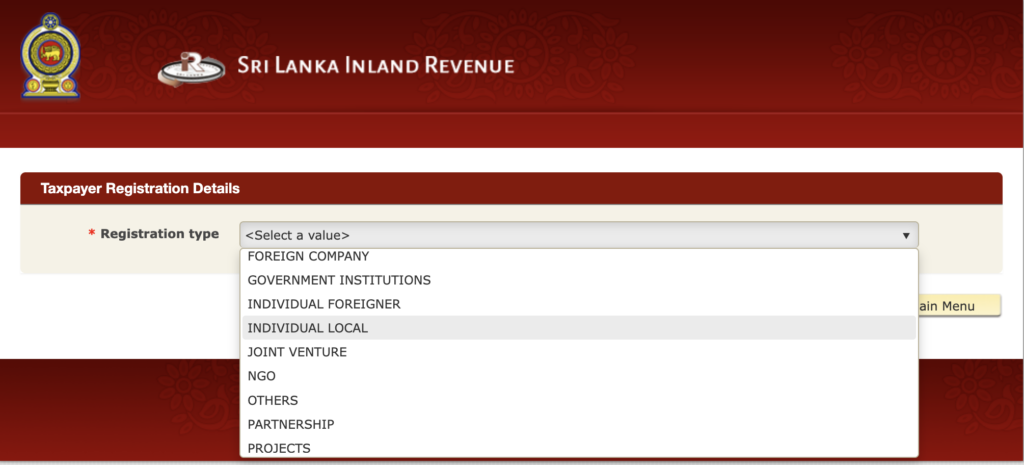

Go to the IRD Sri Lanka website and select your preferred language. On the main menu under e-Services, click on ‘access to e-Services’ and select ‘Click on Taxpayer Registration: To register as a Taxpayer and obtain your TIN’.

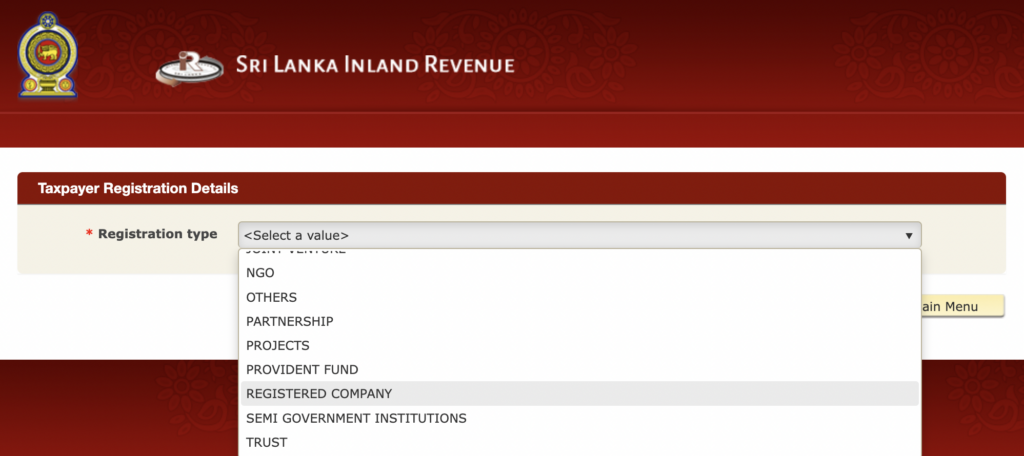

Under Registration Type, select ‘Registered Company’

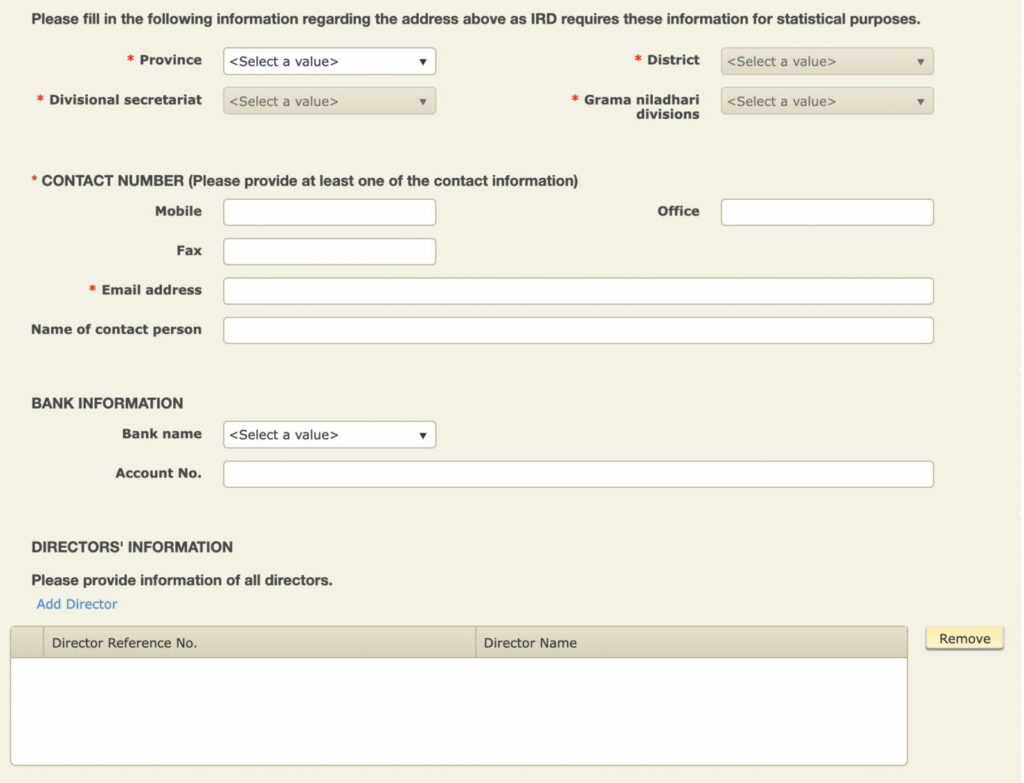

A detailed form will appear below (see the below image for example). Fill in all the necessary details of your business, including selecting your preferred language and mode of communication for when the IRD contacts you.

Be prepared with details regarding your parent company (if any), your director’s information (reference numbers like TIN numbers, NIC or Passport details), and registered address.

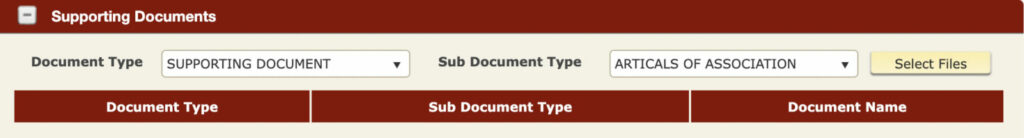

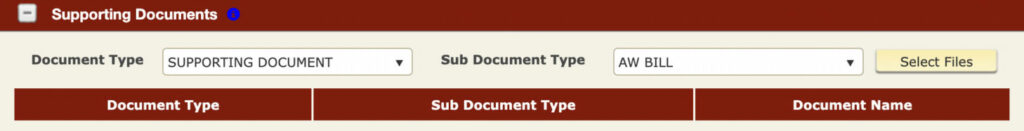

The next step is to upload all your supporting documents. You will have to make sure you have soft copies of all your documents.

Under ‘Document Type’, select ‘Supporting Documents’. You will then have to select the type of documents and proceed with uploading them accordingly.

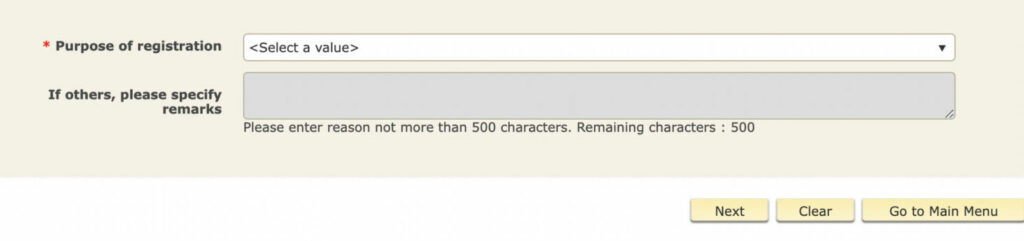

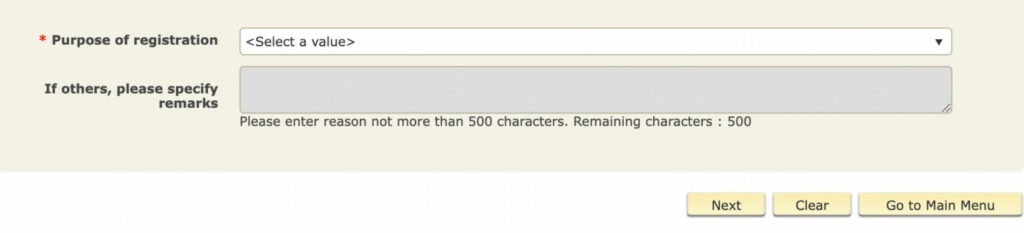

Thereafter, add the purpose of your registration.

And finally, the declaration form, where you have to add in your name, designation, and contact number before submitting the form.

You will then see an acknowledgement/successful submission form on your screen. Be sure to print it out and take note of the acknowledgement number on the form.

And, that’s it! In five – seven working days, you will receive an email with your TIN number.

As an individual taxpayer, you will go through a similar process to that of registering as a corporate taxpayer.

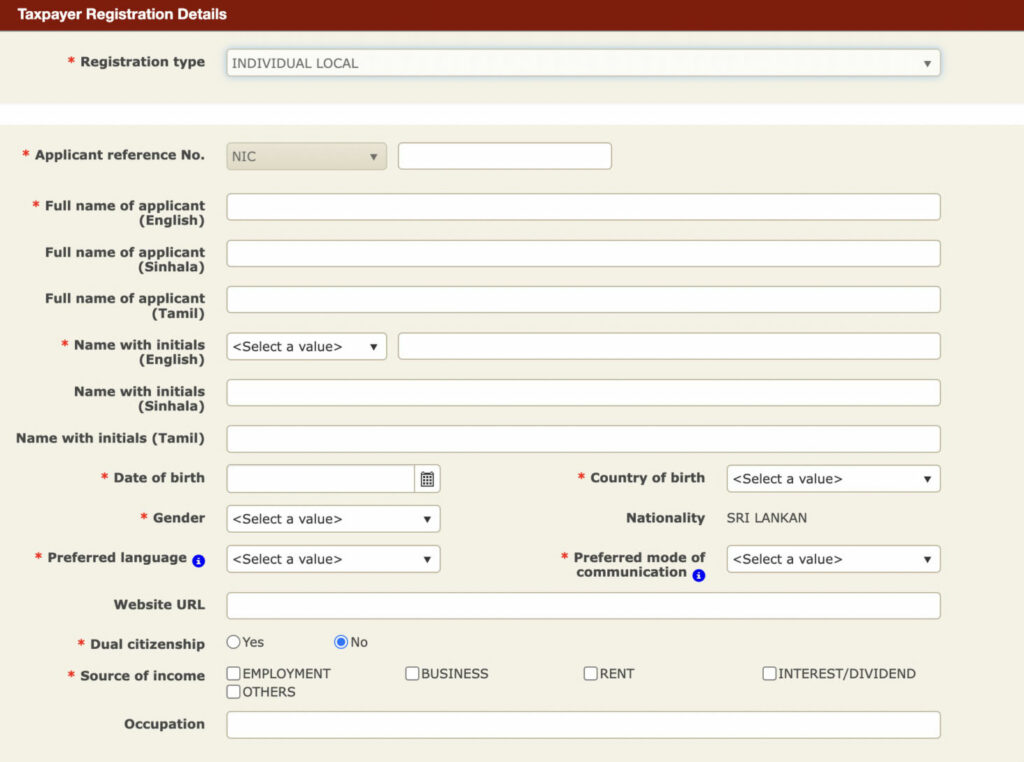

Under Registration Type, select ‘Individual Local’.

A detailed form will appear below (see the below image for example). Fill in all your personal details, like full name, date of birth, gender, nationality, and country of birth.

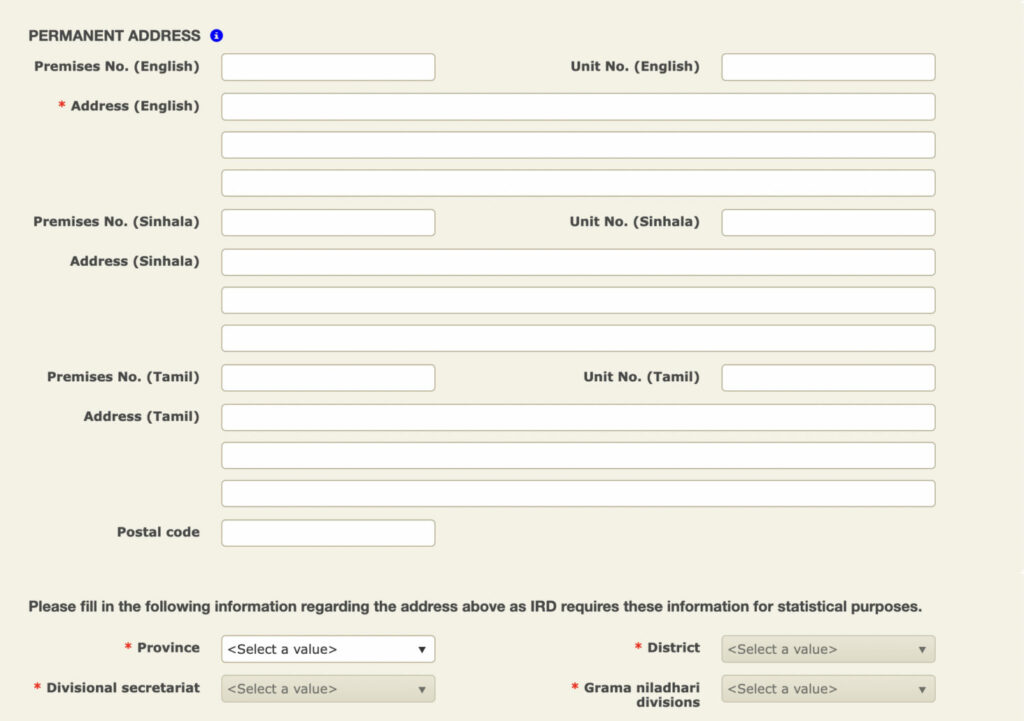

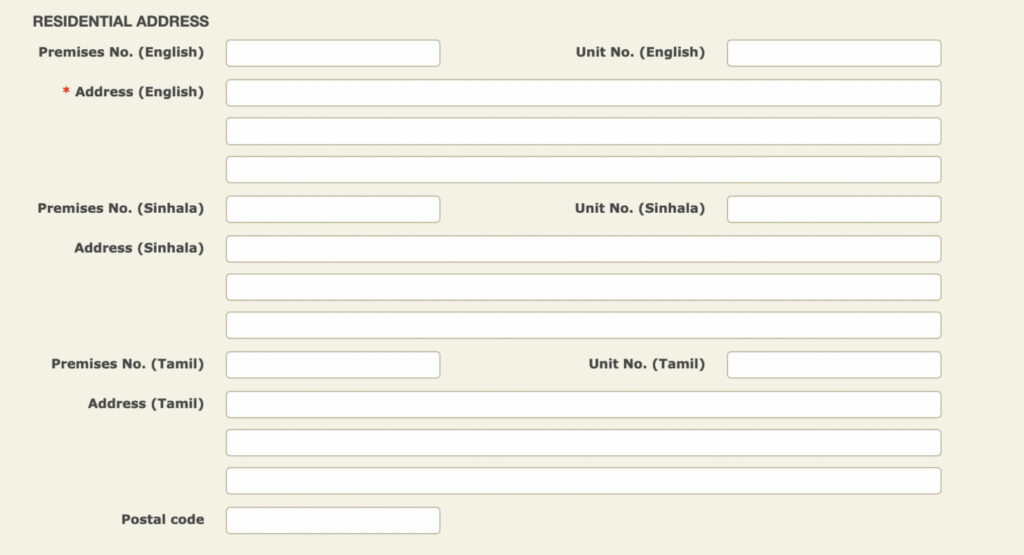

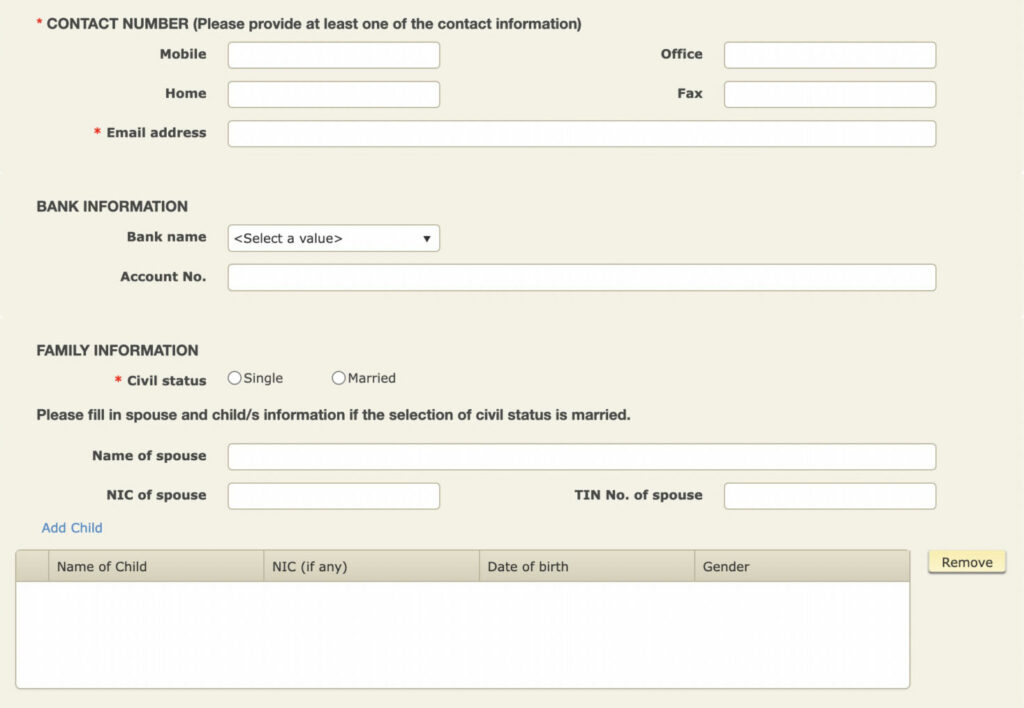

Thereafter, fill in your permanent address, residential address, contact details, bank information, and family information (civil status and spouses/children’s details).

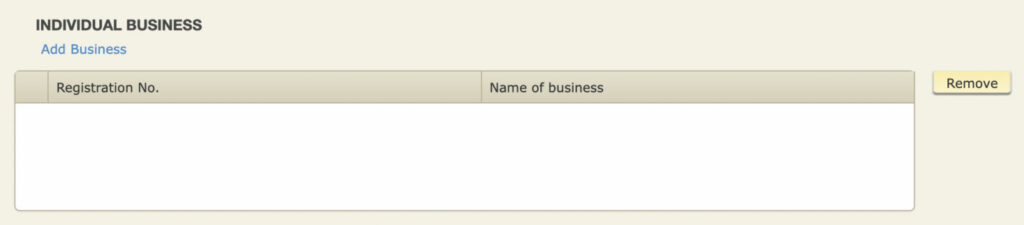

Finally, coming to a section titled ‘Individual Business’, select ‘Add Business’. Fill in the following details on the form:

And, remember to press the ‘save’ button to store all your details.

The next steps are similar to registering as a corporate taxpayer. Upload all your supporting documents, fill in the purpose of your registration, and the declaration form.

You will then see an acknowledgement/successful submission form on your screen. Print it out and take note of the acknowledgement number on the form.

Visit the TPSU at the IRD Head Office and collect a registration form from the officer in charge. Fill in the required details, and submit them, along with your supporting documents. Given that all your details are accurate and your documents are valid, they will issue the TIN number to you immediately.

Note: The IRD Head Office is open from 8:30 a.m. to 4 p.m. (Monday – Friday).

Obtain a registration form from the nearest IRD office or download it here. Fill in the form, attach all your supporting documents, and mail it to the below address,

Commissioner General

Inland Revenue Department

Sir Chittampalam A Gardiner Mawatha,

Colombo 02

You will receive your TIN Certificate by post in a matter of a few working days.

This would apply to offline/in-person registration, and the rules vary depending on the type of business:

In the scenario where someone is submitting a document on behalf of the said individual, a formal letter of authority must be submitted.

And, there you go, that’s it. If you follow these steps, you should be able to obtain your TIN number in a matter of days.

Still, have more questions about obtaining your TIN number? Reach out to us!

Useful links: http://www.ird.gov.lk/en/eServices/Lists/Registration/Attachments/1/TIN%20Registration%20v0%2011.pdf

Now, you should have a pretty good idea of how to obtain a TIN number in Sri Lanka. Make sure your documents are in order, you have all the necessary details for your forms.

At Simplebooks, we are equipped with tax industry experts ready to assist our clients with tax-related matters. If you need help obtaining your TIN, feel free to reach out to us:

Call: 077 270 5624

Email: tax@simplebooks.com

If you need help registering your business, this is something Simplebooks can do for you!

If you’re still confused or have more questions and need some assistance. You can simply sign up for a free consultation with us and we’ll help you out!

The process of getting a TIN number online in Sri Lanka is pretty simple. Head over to IRD Sri Lanka’s website. On the main menu under e-Services, click on ‘access to e-Services’ and select ‘Click on Taxpayer Registration: To register as a Taxpayer and obtain your TIN’.

Depending on the mode of application you have selected, your TIN number will be issued to you immediately (in person), by email (online), or by postal mail.

Yes, you can get your TIN number in Sri Lanka from the TPSU at the IRD Head Office.

A TIN number in Sri Lanka is a nine-digit number that will be on the top left corner of the TIN certificate issued by the IRD Sri Lanka.